You may be familiar with the options listed above, but what do the cost benefits look like to you? What work is involved? Why have an estate sale when you could call a donation company to haul it away and provide you with a tax write off? Why sell an item in an estate sale when you could sell it at auction? In this blog we will explain each service along with an example cost breakdown to help you determine the right solution for you.

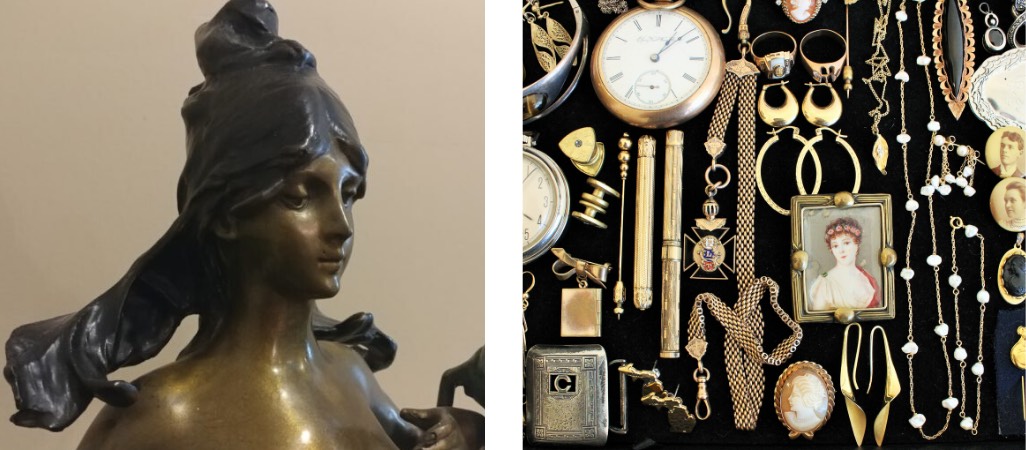

Selling It: Estate Sales

Full estate liquidations can be useful if you have an abundance of items you are looking to part with. You can sell anything from linens to luxury items and the consultation is free. Worst case scenario, you do not qualify for an estate sale and move to other options available to you. Considering you are hiring a professional to do this work for you, it is completely hands off which is an added benefit depending on the stress level of your transition. To learn more about an estate sale consultation, read our blog post “Preparing for an Estate Sale Consultation.”

Benefit: Produces cash to facilitate whichever transition you are experiencing and leaves you with a cleared home ready to list on the market without ever pulling a dime from your bank account.

What is expected of you: Clearing of personal items and any items family and friends would like to keep.

Costs involved: There should be no upfront cost involved. The company should receive payment by keeping a percentage of the total sale.

Situations in which this option could work for you:

- You are downsizing to a condo/RV/Loft/Apartment

- You are upsizing due to family growth or an increase in income

- You have been left to handle an estate from a deceased loved one

- You or a loved one is transitioning into senior living

- You have more than two weeks to get the items removed from the premises

- You are not eligible for a tax donation

- Any situation that the majority of the contents in a home will be left after the transition has taken place

A sample sales accounting breakdown:

Gross profit of your estate sale = $10,000

Company percentage = 48%

Your cut = $5,200

Clean-out cost = $1000

Total Sample Earnings = $4,200

Bidding On It: Auction

Auctions are for those who have a good amount of high end items they need sold offsite. They are also for those who have no deadline and do not need immediate reimbursement for their items. Auctions can be lengthy, expensive, and auction houses are picky with which items they choose to sell. They can take up to 1 year to complete and there is a chance that the items taken to auction may not sell at all, however, would still cost you something for trying.

Benefit: Items sent to auction may bring in more value than expected meaning a greater return on an individual item.

What is expected of you: To choose which items you would like to be sold at auction and to authenticate their value.

Cost involved: If an appraisal of the items is needed there is a fee associated which can be upwards of $75 per hour. There are also fees associated with transportation and storage of the items along with the auction house taking a percentage of the sold items. This percentage is usually a sliding scale determined on the final gavel price meaning the more it sells for the less they will take. However, if it does not sell for the expected price they may take more.

Situations in which this option could work for you:

- No estate sale is needed but you wish to part with a few high end items

- You have an abundance of high end items and wish to part with a few of them

- You have no deadline and it does not matter how long the process takes

- You do not need much or immediate reimbursement for your items

- You do not care if the items do not sell even if that means you have invested money into selling them.

Sample auction breakdown:

Total value of items = $10,000

Total of items sold = $8,000

Auction house sliding scale of final sold price and after all other associated fees = 45%

Total Sample Earnings = $3,200

Same Day Cash: Buyout

Buyouts are rarely offered but could be for those who are looking to get rid of a decent amount of items immediately while still producing some cash in their pocket. The catch here revolves around the fact that the items are being purchased specifically for resale value and are often subjected to a “bulk” buying price. Odds are, the person purchasing this lot of items is doing so in hopes of making money through selling them.

Benefit: If you do not have enough for an estate sale or if your city/association does not allow for estate sales on the premises. This option can be a great way to make some extra cash in a pinch.

What is expected of you: Gather the items you are looking to sell. Get to know them so you can determine if you are receiving a fair amount for them. You will also need to be present during the process to ensure the items purchased and removed from the home are agreed upon.

Costs involved: There should be no upfront cost to you. However, you can expect the items to be purchased at a discounted rate due to the labor involved for the company to remove them, the storage time they expect to invest in the items, and the potential resale value they see.

Situations in which this option could work for you:

- You have a collection you no longer wish to keep

- You are on a deadline of a week or less to get the items cleared

- You live in a condo and the association will not allow for an estate sale

- You have only a handful of valuables you are looking to part with

- You are only looking to sell a few pieces of furniture

- You are not eligible for a tax donation

- The condition of the home does not warrant an estate sale on the premises

A sample buyout accounting breakdown:

Potential total item value = $10,000

Buy-Out offer = $4,000

Total Sample Earnings = $4,000

Waiting It Out: Storage

Storage is a good option when there is an extremely tight deadline or the sentimental attachment / value of the items supports the need to store them. Depending on the reason for storage and the amount of time you are looking to store the items, it can be the right decision.

Benefit: If you are not ready to part with the items, a temperature controlled facility eliminates the rush to make a decision on what to do next.

What is expected of you: You will need to find a way to pack and move the items to storage and it is imperative that they are stored properly to avoid damage.

Cost involved: Varies by location and size and can range from $50 to $200 per month.

Situations in which this option could work for you:

- You do not have enough time to perform any liquidation option and donation does not make sense

- You have sentimental attachment to the items but do not currently have room for them

- You plan to use the items in another space later and the cost to re-purchase the items outweighs their current resale value. (Example: like-new Kitchen-aid mixer. Resale value: $150. New cost: $300)

- You do not mind paying for storage until you make a plan for next steps

- The amount and value of the items will support the cost to store them

A sample cost breakdown:

Total cost to store for 1 year = $1,400

Total cost to pack and move to and from storage = $2,000

Total Sample Cost: -$3,400

Opting for Charity: Donation

Donations are best for those who are eligible to receive a tax deduction from donating and who have no other choice but to donate their items. Donations should always be the last on your list especially if a tax deductible donation slip does not benefit you.

Benefit: Donating items to a good cause is always rewarding.

What is expected of you: You will be solely responsible for contacting donation companies and boxing all items that need to be donated.

Situations in which this option could work for you:

- You have interviewed at least 3 estate sale companies and you do not qualify

- You don’t have enough/desirable items for a buyout

- Time constriction prohibits you from having a sale or buyout

- The items in question are leftovers from a garage sale or yard sale

A sample cost breakdown:

Total item value = $10,000

Tax bracket rules = $3,000 deduction limit

Total Sample Deduction: Up to a $3,000 deduction – (To get the ball rolling on your potential item deduction value, visit the Salvation Army’s Donation Value Guide.

Every situation is unique and when it comes to selling your items, there are many circumstances that could affect the outcome of your process. This blog was written with the intent to provide a basis of understanding. Please feel free to reach out to us, no matter where you are located, if you have any questions about what option is right for you.

Looking into having an estate sale? Check out our blog post “How Estate Sales Work”.